It’s not fun to consider the costs in the case of a car accident, but it’s important. To avoid being surprised by the cost, make sure you select a Damage Protection Plan that you feel comfortable with and that suits your usage.

Our Damage Protection Plans are much more affordable than traditional car insurance, helping you save money compared to owning a car. They say a burden shared is a burden halved, but when you share many cars with many other members your costs are just a fraction of what they would be for car ownership.

The rates in this post are accurate starting May 1, 2025. The rates in this post are subject to change. Find the current rates here.

What is a Damage Protection Plan?

Your Damage Protection Plan limits the amount you have to pay if there’s a collision or damage during your trip. All Communauto vehicles are covered by our company’s insurance for collision and liability, but you get to choose the Damage Protection Plan that works best for you.

By default, a Damage Protection fee is charged per trip. The fee starts at $1.25, plus $1 per hour. The maximum fee is $10 per day and $25 per week. This plan limits your liability for damage to $1000, regardless of fault in an accident.

On this plan, a 1-hour trip would cost $2.25 for damage protection.

For many members, this is perfectly adequate! Especially members who don’t use the service that much and who have $1000 set aside in case of emergency. But when should you consider upgrading to a plan with a monthly fee?

Damage Protection Plans with monthly rates:

For more frequent users, or those who want to limit the fee in the case of an accident, we also offer monthly options. Monthly plans are a minimum 12-month commitment, so if you only wish to be a member for a short time we recommend you stick with the default option.

$500/incident damage protection plan:

This plan is $12.75/month with a damage fee of $500/incident. If you take at least six one-hour trips per month, upgrading to this plan would be more cost-effective than paying $2.25 per trip ($1.25 + $1 per hour).

If you prefer using the cars for a few hours at a time it would only take three trips of three hours each to make this plan as cost-effective as the default option. Just one three-hour trip would cost $4.25 for damage protection on the default plan, plus this option reduces the damage fee to $500/incident. So, if you take several three-hour trips per month this won’t cost you any extra and will provide better coverage in the case of an accident.

If you regularly take trips of over 24 hours, you may also want to upgrade. One two-day trip per month would be $20 for damage protection on the default option. So, if you love a weekend getaway, upgrading may be a better fit.

Plus, in the case of an accident you will pay only half of the cost of the default option.

$0/incident damage protection plan:

What about going a step further? We offer a damage protection plan where you pay $0 in the case of an accident. However, you do pay $17.50/month for this option. When does this become worth it?

Comparing it to the $1000/incident plan if you use the cars for eight hour-long trips each month, you should consider upgrading!

If you regularly use the cars for three hours at a time, it would only take five per month for this plan to be a better deal compared to the default plan. A three-hour trip costs $4.25 for damage protection on the default plan.

And if you love a weekend getaway, or take a few daylong trips each month, upgrading is likely worthwhile. A single two-day trip, or two different day-long trips, would come to $20 for damage protection on the $1000/incident plan. Making the $17.50/month, $0/incident plan a great deal.

This plan can also be a great choice if you are worried about having to pay in the case of an accident, regardless of the number of trips you take. It can bring a lot of stress relief to know that you will pay nothing in the case of an accident.

Waiving Communauto’s insurance in favour of your credit card insurance:

If you have rental car insurance through your credit card, this can be an even more affordable choice. We charge only $3.50 per month for this option, and depending on the coverage available your insurance will likely cover the full cost of damages in the case of an accident.

If we compare this to the $1000/incident default plan you only need to use the cars two times per month to save on the plan fees. It really is a great deal if you have access to another insurance policy!

If you choose to waive our insurance, it is very important to read the terms and conditions of the option you are choosing instead to make sure it covers your situation. To choose this option, please fill in our Damage Protection Plan Waiver form: Damage Protection Plan Waiver – Communauto Atlantic

How do I change my Damage Protection Plan?

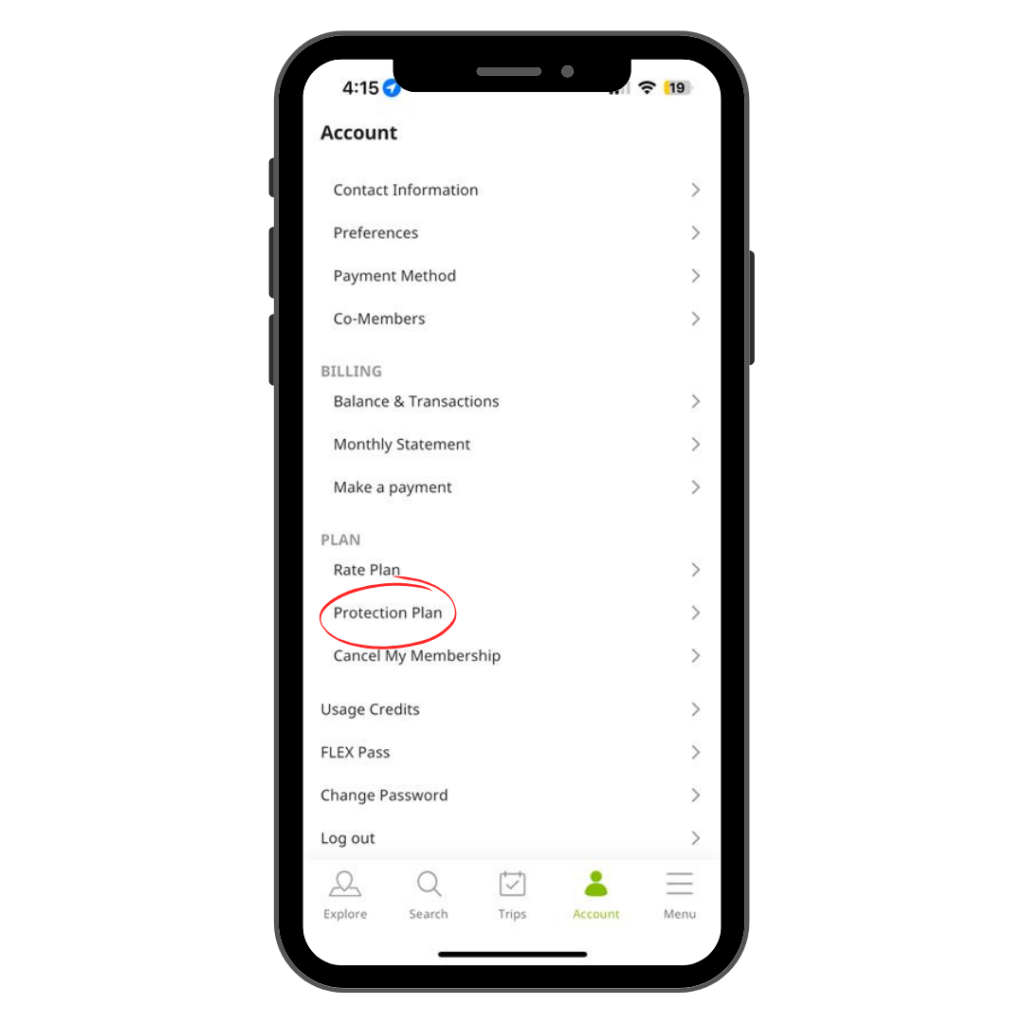

If you are ready for a new plan, you can easily change it yourself. In the app or website, go to “Account” and look under “Plan” to find “Protection Plan”. From there you can request a plan change and even schedule it for the future (for example if you are still within your 12-month commitment or if you wish to schedule a change for after a move).

With this information, you should be ready to choose a Damage Protection Plan that suits you in terms of costs per trip and the costs in the case of an accident. Drive safely and enjoy the ride!